How AI is Transforming Financial Markets

AI, the enigmatic force reshaping the financial landscape! Imagine this: complex algorithms toiling ceaselessly, processing data at a pace that defies comprehension. Plunging into the depths of finance, AI emerges as an unforeseen buoyancy aid. With its capacity to swiftly analyze colossal datasets, it’s akin to having a squadron of supercharged financial analysts at our beck and call.

In today’s frenzied market environment, velocity and efficacy reign supreme, with AI spearheading the charge. As investment luminary Warren Buffett once remarked, “Success in investing doesn’t hinge on IQ beyond 125.” Yet with AI in play, we transcend those cognitive thresholds at breakneck speed. It’s not solely about reaping profits; it’s about outpacing trends and foreseeing market fluctuations before they materialize. Brace yourselves for an exhilarating journey through the tumultuous seas of financial markets – courtesy of AI!

The Rise of Algorithmic Trading

Algorithms, the enigmatic wunderkinds of finance, move with a swiftness that rivals a cheetah on an espresso high, processing data at lightning speed before you can even utter “cha-ching.” But oh, dear comrades, it wasn’t always smooth sailing in the realm of algorithmic trading. No sirree! There were twists and turns along the way. Who could forget the infamous Flash Crash of 2010? Algorithms went wild that day, plunging markets into chaos quicker than you could say “Whoopsie daisy!” But fear not, for we learn from our missteps, do we not? In the immortal words of Warren Buffett himself: “Risk comes from not knowing what you’re doing.” And rest assured, these algorithms now know exactly what they’re up to.

In this day and age, algorithmic trading reigns supreme like Beyoncé in the financial arena omnipresent and dominating. Whether it’s high-frequency trading or statistical arbitrage, these algorithms are bringing home the bacon for those who have mastered their game plan. As George Soros once mused: “It’s not about being right or wrong; it’s about how much dough you rake in when you hit bullseye and how much slips through your fingers when things go awry.” And let me tell you something these algorithms ensure that when they hit jackpot, dollar bills rain down like there’s no tomorrow. So next time algorithmic trading crosses your mind… remember this is more than just a passing fad; this is the future beckoning us forward!

Machine Learning in Stock Forecasting

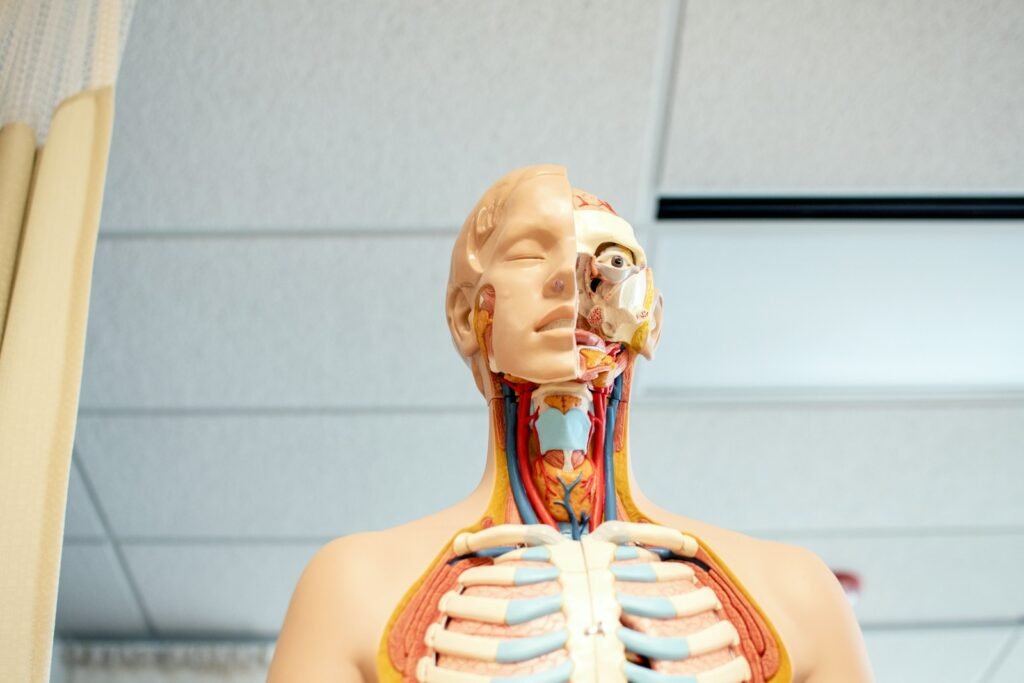

The realm of stock forecasting has always been a labyrinth of conjecture and informed guesses. However, with the emergence of machine learning algorithms, it’s as if we have stumbled upon a mystical crystal ball that actually delivers results. These sophisticated algorithms possess the ability to process vast amounts of data at lightning speed, uncovering elusive patterns and trends that even the most seasoned traders struggle to identify.

Picture yourself being able to forecast stock movements with eerie precision, all thanks to the extraordinary capabilities of machine learning. As esteemed economist and Nobel laureate Daniel Kahneman once remarked, “The illusion that we understand the past fosters overconfidence in our ability to predict the future.” Yet, machine learning dismantles this illusion effortlessly, aiding us in deciphering the tumultuous nature of the stock market. It’s akin to having an empowered ally by your side whispering market secrets directly into your ear.

Automated Trading Strategies

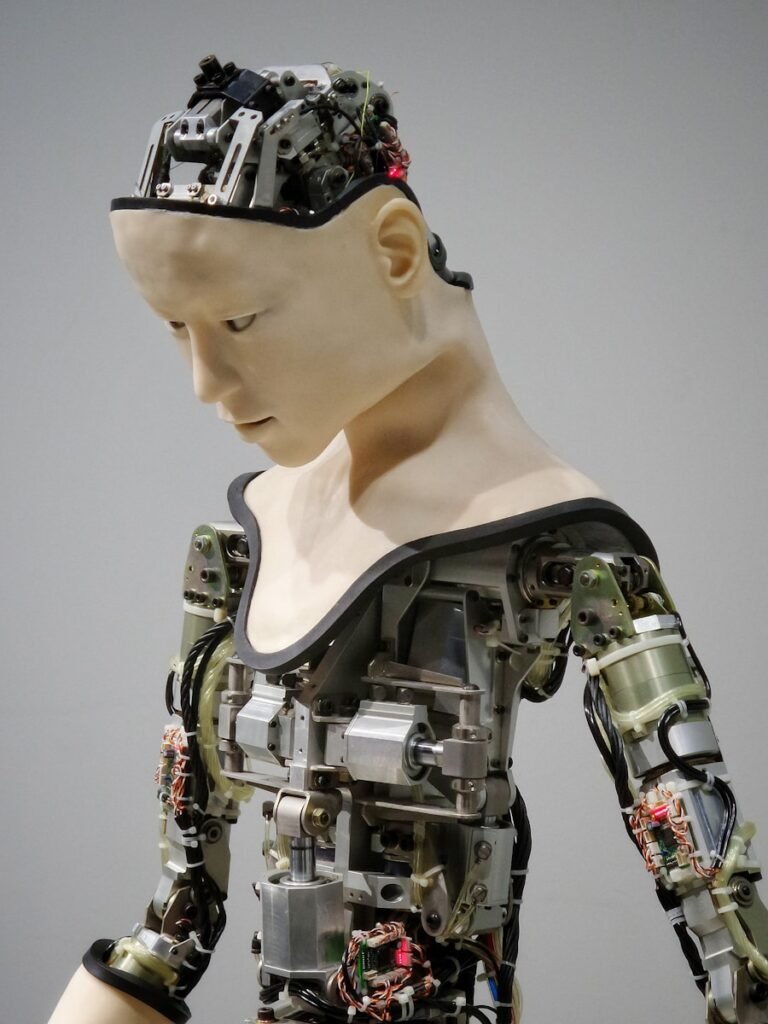

Imagine having a robotic ally in the chaotic realm of the stock market – tirelessly analyzing data and making transactions at lightning speed. While you leisurely sip your morning coffee, your AI companion is out there navigating the unpredictable market with unwavering determination. It’s a surreal partnership where one never tires, constantly immersed in the fast-paced world of trading.

In this high-octane environment, swiftness is paramount. As quoted by Jesse Livermore, an iconic figure in stock trading history, “The game of speculation is the most uniformly fascinating game in the world.” However, it’s not for those lacking intellect or emotional stability; it requires patience and strategy over impulsive decisions. Automated trading strategies revolutionize this game by introducing unparalleled efficiency and accuracy. With AI leading the charge, trades are executed instantaneously, responses to market shifts are immediate, and tactics evolve seamlessly on-the-go. It’s akin to possessing a genius mind that instinctively knows when to pounce or retreat at any given moment.

The Role of AI in High-Frequency Trading

High-frequency trading is the espresso of finance – fast, intense, and sometimes leaving you questioning your caffeine intake. AI takes center stage in this high-octane spectacle, where split-second judgments can determine success or ruin. Imagine algorithms darting past like bullets, analyzing market data at warp speed in the blink of an eye. It’s akin to a Formula 1 race on the stock market track, with computer programs as drivers programmed to outwit each other.

In this realm of high-frequency trading, AI orchestrates a symphony of mathematical models and data flows. As physicist Stephen Hawking famously mused, “The emergence of potent AI could be either humanity’s greatest triumph or downfall.” In the domain of high-speed trading, it embodies both – a razor-sharp tool that cuts through market inefficiencies with precision. It’s a tumultuous journey where fortunes shift rapidly, only favoring the most agile participants. Like a rollercoaster ride not meant for the faint-hearted; those bold enough to embrace AI advancements in finance may reap astronomical rewards.

Implications of AI on Market Volatility

Imagine, if you will, the concept of AI in financial markets being likened to entrusting a toddler with a Ferrari – an exhilarating yet anxiety-inducing endeavor. The addition of AI to market volatility is akin to giving that Ferrari a turbo boost. Picture this: AI algorithms processing millions of data points in the blink of an eye and executing trades quicker than one can utter “buy low, sell high.” It’s as though we now have an ultra-fast, super-intelligent financial advisor who never rests. However, as they say, with great power comes great responsibility.

Market volatility has forever been the heart-pounding rollercoaster ride of finance, and AI has injected some unexpected twists and turns into the mix. As these algorithms analyze numbers and make lightning-fast decisions, the market may witness sudden spikes or plunges that leave traders and investors bewildered. In the words of Warren Buffett himself, “The stock market is designed to transfer money from the Active to the Patient.” With AI at play, it seems like patience is indeed crucial perhaps even combined with a touch of magic to predict where the market will shift next when all logic suggests otherwise. So fasten your seatbelts because with AI taking control, we’re in for quite a thrilling journey!

Challenges and Risks of AI in Trading

The world of AI in trading is like a rollercoaster ride with a blindfold on – thrilling yet anxiety-inducing. One of the biggest hurdles we encounter is the danger of “overfitting” our algorithms, where they get too absorbed in historical data and lose sight of the bigger picture. As Warren Buffett famously said, “In business, hindsight is always 20/20.” Finding the right balance between past patterns and future uncertainties is crucial to avoid getting lost in over-optimization.

Furthermore, the rapid progress in AI technology brings with it the threat of “black box” decision-making, where algorithms become so intricate that even their creators struggle to unravel them. This lack of transparency can lead to unforeseen consequences and amplify market turbulence. Remember, “With great power comes great responsibility.” It’s imperative for us to consistently assess and supervise AI systems to ensure they align with our objectives and ethical standards, steering clear of potential pitfalls along the way.

The Future of AI in Financial Markets

In the mystical crystal ball of financial markets, a perplexing revelation emerges – AI is poised to become a central figure in shaping the landscape. With algorithms growing ever more intricate and machine learning models constantly evolving, the horizon holds a tantalizing vision of improved decision-making processes and lightning-fast transactions. Picture having a digital companion at your side, swiftly crunching numbers and making strategic maneuvers at an instant’s notice. As Sam Altman once proclaimed, “AI is the new electricity,” illuminating the path for financial markets towards unparalleled levels of efficiency and innovation.

Envision a realm where trades materialize in mere fractions of seconds and market trends are foreseen with eerie precision. This is the world that AI beckons us towards, where automated trading strategies are not merely convenient but imperative for staying ahead of the game. The era of human traders laboriously analyzing endless charts and data may soon fade into oblivion, supplanted by intelligent systems capable of adapting and learning on-the-fly. In Ray Kurzweil’s words, “We won’t experience 100 years’ worth of progress in this century — it will be more akin to 20,000 years’ worth.” And without doubt, the future role of AI in financial markets appears ready to catapult us into an epoch brimming with possibilities and potentialities.